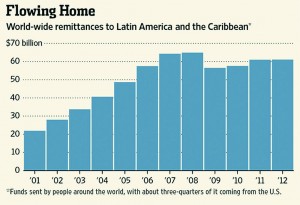

Remittances to Latin America and the Caribbean (LAC) showed a slight increase in 2012 with respect to the previous year, according to the latest report on remittances by the Multilateral Investment Fund (MIF), a member of the Inter-American Development Bank Group. Remittances to Guyana were pegged at US$469.3 million for last year, representing more than 10 per cent of the country’s Gross Domestic Product.