By Svetlana Marshall

Anil Nandlall

The People’s Progressive Party/ Civic (PPP/ C); the A Partnership for National Unity (APNU); and the Alliance For Change (AFC) are likely to return to the negotiating table to plot the way forward on the passage of the Anti-Money Laundering and Countering the Financing of Terrorism (Amendment) Bill.

This round of discussion is critical to prevent Guyana from experiencing a financial crisis owing to the move by the Caribbean Financial Action Task Force (CFATF) to blacklist the country for non-compliance with anti-money laundering and countering the financing of terrorism standards.

After voting down the bill in the National Assembly on November 7, the APNU and the AFC have since indicated that they will support the retabling of the bill, but it must be recommitted to the parliamentary special select committee.

The onus is on the PPP/ C to retable the defeated bill.

Addressing the press at Freedom House on Monday, Legal Affairs Minister Anil Nandlall said the government of Guyana will be assessing the possible avenues to be taken, indicating discussions with the two opposition political groupings are possible.

With Guyana being blacklisted by CFATF during its November 20 Plenary in The Bahamas, Nandlall said it was essential for the country to take the necessary steps to reduce the impact.

Greater sanctions

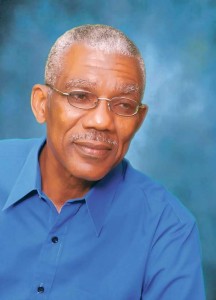

David Granger

CFATF’s next plenary is set for May 2014; however, Guyana could be placed under the microscope in February 2014 when the global anti-money laundering body, the Financial Action Task Force (FATF) meets. Hence, the bill which incorporates CFATF recommendations should be passed by February to avoid further uncertainty.

CFATF has already indicated that if the bill is not passed in May 2014, Guyana will be handed over to FATF’s International Cooperation Review Group (ICRG), resulting in greater financial sanctions.

“The amendments which have been rejected by the opposition in the National Assembly ought to be passed even before February, so that Guyana will no longer be a country with those identified deficiencies,” Nandlall posited.

Guyana, along with Belize, was blacklisted by CFATF due to its failure to rectify key strategic deficiencies in its Anti-Money Laundering and Countering the Financing of Terrorism Act. Initially, an action plan was developed to address the deficiencies, but Guyana failed to adhere to the plan.

CFATF has advised its members to consider the implementation of counter-measures to protect their financial systems from the ongoing money laundering and terrorist financing risks emanating from Guyana.

It was pointed out that commercial banks in Trinidad and Tobago have already heightened their security systems for transactions with Guyanese companies, following a warning letter from the Trinidad and Tobago Central Bank. The legal affairs minister indicated that a commercial bank in the U. S. has severed ties with a local commercial bank as a result of Guyana’s failure to comply with the CFATF requirements.

Return to normalcy

“If we are able to pass this bill – if not before February – by May, then Guyana can extricate itself from this list that it finds itself on and we can be restored to some level of normalcy,” he reiterated.

Questioned on whether government should share the blame for Guyana being blacklisted, Nandlall responded in the negative, claiming that the PPP/ C took the necessary step to prevent blacklisting, but did not garner the needed support of the APNU and AFC.