…before 2022 deadline

Guyana has been congratulated on its efforts to improve its anti-money laundering and countering the financing of terrorism (AML/CFT) framework, but Government is being encouraged to work towards ensuring that the country becomes compliant with all standards before the 2022 deadline.

World Bank’s Senior Financial Sector Specialist Stuart Yikona told a recent finance workshop held to discuss the AML/CFT framework that the self-assessment done by Guyana is the easiest part of the process, but the country now needs to move ahead with implementation.

“I would like to commend the hard work, determination and persistence you have demonstrated throughout this entire process. This is a self-assessment that was led by you, the people of Guyana. The difficult part comes in now — in implementing the actions of the tasks identified, or mitigate or reduce; and in some cases, if possible, eliminate the threats and vulnerabilities that you face,” he explained.

He also encouraged Government to begin the process now, and pledged the World Bank’s continued support with the implementation of an action plan.

Yikona said, “We would like to encourage you not to wait until 2022 to begin the process of achieving some of the quick-wins. For example, one of the things required is to disseminate the findings and conclusions to the private and public sectors, so that they can understand the risks and threats.”

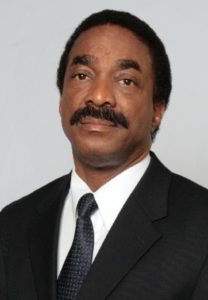

Attorney General and Legal Affairs Minister, Basil Williams, has noted that this process is fundamental to the further development of Guyana’s AML/CFT regime, as it would help to improve on the existing framework.

Williams said the authorities would prioritise, and focus on the most crucial areas and strategically allocate resources to strengthen these areas, and address the loopholes in the regime.

The fourth round of Mutual Evaluations by the Caribbean Financial Action Task Force (CFATF) in 2022 will test the effectiveness of Guyana’s AML/CFT regime.

Guyana had, for more than a decade, been actively pursuing the objective of meeting regional and international expectations on money laundering and terrorist financing.

The AML/CFT Bill was first passed in 2000, and then repealed and replaced in 2009, after which several amendments were passed to strengthen the legislative framework.

But despite these efforts, the country continued to fall below the standards of international bodies, which led to the need for a national risk assessment.

The assessment was conducted with the help of the World Bank and other agencies, like the Inter-American Development Bank and the United States.