…go from $25B in 2014 to $1.9B in 2018

By Jarryl Bryan

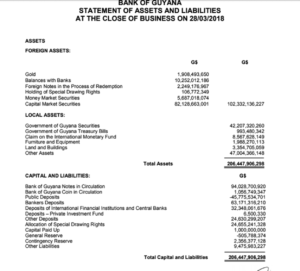

The Bank of Guyana’s latest Statement of Assets and Liabilities are out and it shows the bank’s total assets are on a slide, with several indices ranging from the bank’s gold holdings to its market securities showing reductions when compared to previous years. The statement was only recently released.

According to the bank document, its total assets as of March 28, 2018, were $206.4 billion. This includes $1.9 billion in gold reserves, $82.1 billion in capital market securities and $5.6 billion in money market securities.

This is a reduction from the gold reserves the bank recorded in June 2017. According to the bank’s Half Year Report last year, it had $4.8 billion worth of gold in its foreign holdings as assets.

Indeed, the gold reserves have steadily been declining with each passing year. At the end of 2016, the bank had $7.4 billion in gold, while at the end of 2015 the gold reserves stood at $14.2 billion. At the end of 2014 the bank of Guyana had $25 billion in gold as assets.

In the case of total assets, that has also seen a marked decrease. At the end of 2014, total assets were $207.9 billion. It reduced in 2015, being recorded at $188.7 billion in December of that year, before recovering by 2016 year end and being recorded at $220 billion. At June 2017, total assets were $221.8 billion, before the drop recorded in this year’s figures.

Gold price

The practise of countries selling the gold it held in reserves is not an uncommon one. Many countries hold billions of dollars in gold as a “back up” in time of inflation or economic downturn. It is usually in these cases that the gold is then sold.

At present, gold prices are approximately US$1350 per ounce. It has fluctuated over the years, at one point hovering around the US$1000 per ounce mark in 2016. In Guyana’s case, observers are likely to worry whether the State received the best price the world market could offer.

Other considerations would see links being established between the steady selling off of gold and Guyana’s regressing economic standing. Only a few days ago, Finance Minister Winston Jordan confirmed that Guyana recorded a growth rate of just 2.1 per cent for the 2017 fiscal year. He had linked the dismal figures to sectors including sugar.

“The economy did not perform as robust as we expected during last year. Even at the half year we were predicting that the economy would not, given what we knew about sugar. At the end of the day, it was even worse than we predicted. So even though there was positive growth last year, the growth rate ended up being 2.1 per cent.”

“Sugar, we had budgeted at 208,000 tonnes, came in at only 137,307 tonnes. Bauxite again did not do quite well. We had budgeted 1.7 million tonnes. Bauxite came in at 1.4 million. Gold (was a) major disappointment. We budgeted at 694,000 ounces. It came in at 653,674 ounces.”

Rice, it seems, was one of the few bright spots, with the Minister reporting that from a target of 600,000 tonnes, rice came in at 630,104. Having budgeted for 318,000 cubic metres, forestry recorded 349,900 cubic metres. Jordan noted that this is better than previous years. According to Jordan, the overall state of the economy is nothing new.

“I think I’ve been quite open with you about this economy, in the sense that this economy has not changed much in over 50 years, depending on one or two products, which depends on what prices are. One day you’re up when gold is up, one day you’re down when bauxite is down.”

“Our critical sectors have always depended on some grandfather, that grandfather being some protectionist market. In the case of sugar, that grandfather being the ACP markets. In the case of rice, rice has always had some kind of grandfather market,” Jordan explained.

Previously, Jordan had said the economy was expected to grow by 2.9 per cent, failing to meet the revised growth projection of 3.1 per cent for 2017. The initial projected growth of the economy was 3.8 per cent. This was, however, revised by midyear to 3.1 per cent after the economy only grew by 2.2 per cent by July. ( Jarryl Bryan)