The transformation of what was once Sanata Textiles Complex, now known as the Queens Atlantic Investment Inc (QAII) Complex, located at Industrial Site, Ruimveldt, Georgetown, can be described as significant, to say the least, following the quantum of investment and the voluminous work carried out to ensure that a modern, state-of-the-art facility would be constructed.

Background

Sanata Textiles Limited was dissolved under the Public Corporations Act pursuant to the Sanata Textiles Limited (Dissolution and Transfer of Assets and Liabilities) Order No 49 of 2000. All assets were then transferred to the National Industrial and Commercial Investments Limited (NICIL) from December 29, 2000. The property was leased to G&C Sanata Company Inc. That company was forced to downscale and later cease complete operations. The complex was left abandoned for several years.

The handover of all G&C Sanata Company Inc’s assets to NICIL resulted in government assuming full responsibility and control of the complex. Several challenges were encountered namely:

Security ― Despite a change of three different security firms, the complex located at Industrial Site, Ruimveldt was still subject to numerous break-ins and theft. Millions of dollars in losses were suffered as a result of those crimes. Equipment, furniture and cables were among the items stolen. The electrical cables attracted the thieves, given their high retail value in the scrap metal trade. There were also a number of cases of gunfire in the compound as thieves engaged with security.

Vandalism ― due to the ongoing theft, the equipment and installations were vandalised beyond repair and had little or no value at the time of privatisation. The electrical circuitry was severely damaged from the theft of cables and panels, resulting in the compound being in a state of darkness.

High maintenance costs ― Added to the losses incurred as a result of theft and vandalism, maintenance of the complex proved costly, burdening NICIL. Some Gy$20 million had to be budgeted annually towards payment of insurance, rates and taxes, repairs and maintenance, water, electricity, security, salaries and other miscellaneous expenses.

In light of these challenges, a decision was made to have Sanata Textiles complex privatised. This process began in the last quarter of 2006 with advertisements for the former G&C Sanata operations. THIS WAS DONE NO LESS THAN 20 TIMES AND NO BIDS WERE RECEIVED. The original closing date of January 19, 2007 was extended to February 28, 2007 to encourage interest from both local and overseas investors, but yet no bids were received.

Investors were then invited to submit tenders for the leasing of assets (plant and machinery of the printing and dyeing factory) and the leasing of land and buildings or factory associated with the printing and dyeing factory.

This is as a result of the rules of competitive bidding of the Privatisation Policy Framework Paper of June 1993, where it was stated that where an entity has been advertised and there are failed bids, direct negotiations can be ensued with interested parties. Relying on this policy and past precedence set by the privatisation of Linmine to Omai in 2003 following the non-receipt of bids to privatise, NICIL began negotiations with QAII for the lease of the complex.

In April 2007, QAII submitted a business plan to lease the complex. The business proposal was unanimously recommended for approval following detailed discussions and negotiations with the Privatisation Board on May 9, 2007. Cabinet subsequently endorsed the recommendation. Key terms of the proposal included: the lease rate being set in US$ and being payable in the equivalent Guyana dollars at the date of payment; the lease rate being indexed to the rate of inflation in the U.S. after 2009; and all rates and taxes being to the account of the lessee.

Benefits of QAII proposal

The Privatisation Board and Cabinet considered the following benefits in accepting the proposal: Utilisation of the land and buildings which had fallen into a state of dilapidation and vandalism; Avoidance by NICIL of the high level of maintenance, security, rates and taxes, and insurance associated with the property; Creation of new jobs; Conversion of the property which was not making a net return into an entity with positive cash flow and the Encouragement of economic activity in the Ruimveldt Industrial Area.

On June 4, 2007, a lease agreement between NICIL and QAII was entered into for a 99 year lease with an option to purchase after the completion of three years. The rental paid by QAII was 50 times greater than the average rent paid to the government by other companies in comparative industrialised areas. Other companies have typically paid as little as G$1 per square foot, a fraction of what was being paid by QAII.

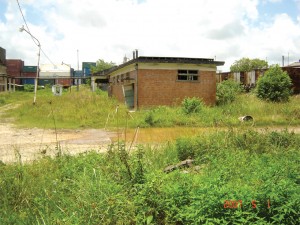

At the time of acquisition, the entire complex was in a state of disrepair. Fences had fallen apart; Drains were blocked; Roads were inaccessible; Vegetation was overgrown; Garbage was prevalent; Equipment and installations were vandalised beyond repair; The buildings were infested with termites and unfit for occupation; There was also flooding in some sections despite it being the dry season.

The pictures depict the state of the compound on acquisition by OAII in 2007.